How Much Money Can You Make From an Oil Well (Complete Guide)

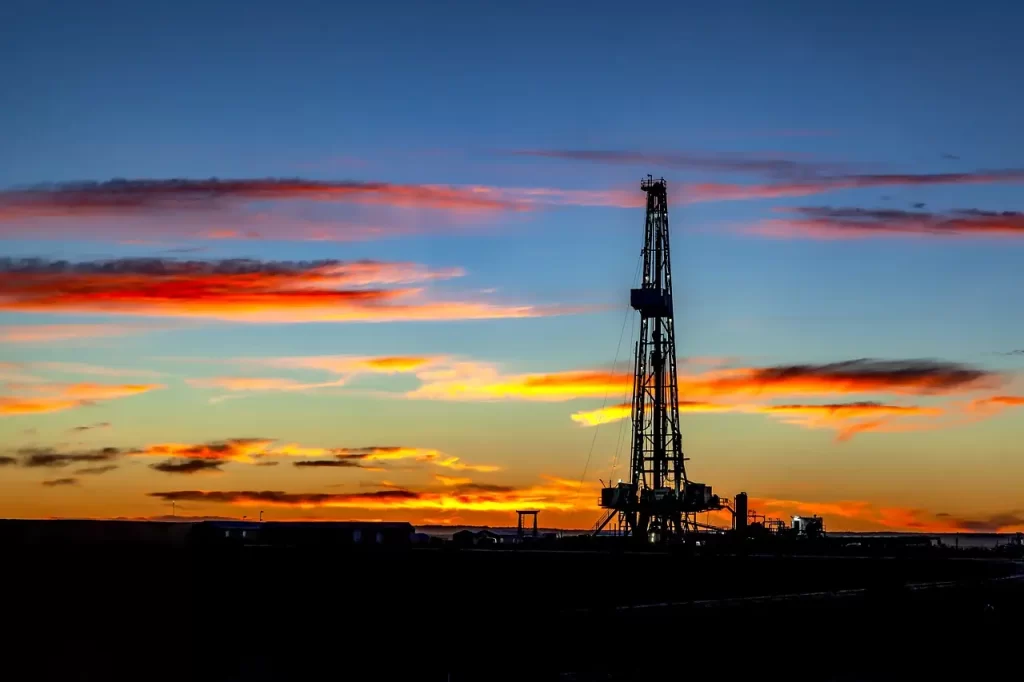

Imagine the vast expanse of a barren landscape, dotted with towering oil wells silently extracting the earth’s black gold. You can’t help but wonder, how much money can you make from an oil well? The answer lies in a complex web of factors that influence your potential earnings. From the location and state to the company you work for, every aspect plays a crucial role in determining your salary.

So, if you’re ready let me tell you how much money you can make from an oil well and to become rich as a troll! In this article I will write about the highest paying states, the average salaries in different regions, and the variables that ultimately shape your income from an oil well.

Yes, the amount of money you can make from an oil well varies significantly based on factors such as the location, size, and productivity of the well. It is not possible to provide a specific amount without considering these variables.

Factors Impacting Oil Well Earnings

Geological factors, oil prices, and production costs are all important factors in determining the earnings from an oil well. The location and geological characteristics of an oil well directly impact its profitability. Some areas have more abundant and easily accessible oil reserves, leading to higher potential earnings. On the other hand, locations with limited or difficult-to-reach oil reserves may result in lower profits.

Fluctuations in oil prices also have a direct influence on the amount of money an oil well can generate. When oil prices are high, the revenue from oil production increases, resulting in greater earnings. Conversely, when oil prices drop, the profitability of an oil well decreases.

Production costs, including drilling, operating, and maintaining the well, also affect earnings. Higher production costs can eat into the revenue generated by the oil well, reducing the overall profitability.

Well productivity, or the amount of oil extracted over a given period, is another crucial factor in determining earnings. Higher production rates lead to greater revenue, resulting in higher earnings.

Lastly, royalties and taxes imposed by the government can significantly impact the amount of money earned from an oil well. These costs reduce the overall profitability and should be considered when assessing potential earnings.

Highest Paying States for Oil Rig Workers

If you’re looking for the highest paying states for oil rig workers, look no further than New York and Vermont. In these states, oil rig workers can earn an annual salary ranging from $54,332 to $55,088.

New York offers the highest annual salary for oil rig workers at $55,088, with a monthly pay of $4,590, a weekly pay of $1,059, and an hourly wage of $26.49.

Following closely, Vermont offers an annual salary of $54,332, a monthly pay of $4,527, a weekly pay of $1,044, and an hourly wage of $26.12 for oil rig workers.

Other states that rank among the highest paying include Pennsylvania, New Hampshire, and New Jersey. Pennsylvania provides an annual salary of $50,445, New Hampshire offers $49,300, and New Jersey offers $48,768 for oil rig workers.

It’s important to note that the amount of money you can make from an oil well varies depending on factors such as the location, the state, and the company you work for. However, if you’re looking to make the most money as an oil rig worker, considering these highest paying states is a good place to start.

Lowest Paying States for Oil Rig Workers

The states with the lowest salaries for oil rig workers include Arkansas, Florida, Michigan, Kentucky, and West Virginia.

In Arkansas, oil rig workers can expect an annual salary of $36,284, which translates to a monthly pay of $3,023, a weekly pay of $697, and an hourly wage of $17.44.

Similarly, in Florida, the annual salary for oil rig workers is around $37,004, with a monthly pay of $3,083, a weekly pay of $711, and an hourly wage of $17.79.

Michigan offers a slightly higher annual salary of $38,152, with a monthly pay of $3,179, a weekly pay of $733, and an hourly wage of $18.34.

Meanwhile, in Kentucky, oil rig workers can expect an annual salary of $38,222, a monthly pay of $3,185, a weekly pay of $735, and an hourly wage of $18.38.

Lastly, in West Virginia, the annual salary for oil rig workers is approximately $38,960, with a monthly pay of $3,246, a weekly pay of $749, and an hourly wage of $18.73.

Despite the lower salaries in these states, oil and gas production remains an important industry, providing employment opportunities and contributing to the local economies.

Average Salary in Western States

In Western states, such as California and Alaska, oil rig workers can expect to earn an average annual salary ranging from $42,223 to $48,018. These states offer competitive wages for oil rig workers due to the abundance of oil and gas production in the region.

The average salary in California is around $42,223, which translates to a monthly pay of $3,518, a weekly pay of $811, and an hourly wage of $20.30. In Alaska, the average salary is higher at $48,018, with a monthly pay of $4,001, a weekly pay of $923, and an hourly wage of $23.09.

These salaries reflect the importance of the oil industry in these states and the demand for skilled workers in the field. With the oil and gas industry continuing to thrive in Western states, oil rig workers can expect to earn a decent income by being involved in the production of oil and gas.

Average Salary in Southern States

Moving on to the average salary in Southern states, you’ll find that oil rig workers can earn a decent income in states like Texas, Louisiana, Oklahoma, Mississippi, and Alabama.

In Texas, the average annual salary is $39,956, with a monthly pay of $3,329, weekly pay of $768, and an hourly wage of $19.21.

Similarly, in Louisiana, the average annual salary is $39,961, with a monthly pay of $3,330, weekly pay of $768, and an hourly wage of $19.21.

Oklahoma offers an average annual salary of $40,163, with a monthly pay of $3,346, weekly pay of $772, and an hourly wage of $19.31.

In Mississippi, the average annual salary is $42,796, with a monthly pay of $3,566, weekly pay of $823, and an hourly wage of $20.58.

Lastly, Alabama provides an average annual salary of $44,885, with a monthly pay of $3,740, weekly pay of $863, and an hourly wage of $21.58.

These salaries demonstrate that working in the oil industry in Southern states can be financially rewarding. Whether you’re interested in mineral rights, oil companies, investing in oil, or royalty payments, the Southern states offer opportunities for a stable income.

Average Salary in Northeastern States

If you’re looking to work in the oil industry and earn a high salary, the Northeastern states offer some of the best opportunities, with New York leading the way with an average annual salary of $55,088. In addition to New York, other Northeastern states such as Massachusetts, Connecticut, Rhode Island, and New Jersey also offer competitive salaries in the oil industry.

Massachusetts has an average annual salary of $48,191, while Connecticut offers an average annual salary of $43,361. Rhode Island provides an average annual salary of $44,079, and New Jersey has an average annual salary of $48,768. These salaries in the Northeastern states are higher compared to the national average, making them attractive options for those seeking lucrative careers in the oil industry.

Working in the oil industry in the Northeastern states can provide you with significant financial rewards. With the high average salaries in these states, you can earn a good income while working in the oil industry. This can be especially beneficial when considering the potential for oil royalties and investment opportunities.

The Northeastern states offer a favorable environment for oil production, with relatively low production costs and abundant resources. This creates a promising landscape for individuals looking to earn money from an oil well. Whether you’re interested in working on an oil rig or exploring investment opportunities, the Northeastern states present a compelling case for financial success in the oil industry.

Variables Determining Oil Well Earnings

The variables that determine earnings from an oil well include the size of the property, its historical performance, the estimated number of oil reserves, the percentage of mineral rights ownership, and the royalty percentage defined in the lease agreement. These factors directly impact the potential earnings from an oil well.

Firstly, the size of the property plays a crucial role in determining the amount of oil that can be extracted. A larger property has a higher chance of containing a significant amount of oil reserves, leading to higher potential earnings.

Secondly, the historical performance of the property is important. If the property has a track record of successful oil production, it indicates the presence of productive oil reserves, which can result in higher earnings.

The estimated number of oil reserves on the property is another key factor. The more oil reserves there are, the greater the potential for earnings from the oil well.

Furthermore, the percentage of mineral rights ownership is significant. If an individual or company owns a higher percentage of mineral rights, they’re entitled to a larger share of the oil well’s earnings.

Lastly, the royalty percentage defined in the lease agreement determines the amount of money the owner receives for the oil extracted. A higher royalty percentage means higher earnings from the oil well.

It is important to note that there are costs associated with operating an oil well, such as drilling and maintenance expenses. These costs need to be considered when calculating the overall earnings from an oil well.

Oil Royalty Earnings Calculator

To better understand the potential earnings from an oil well based on various factors, such as property size and ownership, one helpful tool is the Oil Royalty Earnings Calculator. This calculator uses defined variables to estimate earnings and determines royalty payments based on the share of production. By inputting the amount of oil produced and your share of the production, the calculator provides an estimate of your potential royalty payments.

These payments can range from a few dollars to hundreds of thousands per month, depending on the factors involved. The Oil Royalty Earnings Calculator allows for a quick assessment of potential earnings from an oil well, helping individuals understand the financial benefits of oil well ownership.

Whether you’re considering investing in an oil well or already own one, this calculator can give you an idea of the money you could make. It’s a useful tool for anyone involved in the oil industry looking to gain insights into their potential earnings.

Conclusion

In conclusion, the earnings from an oil well can vary greatly depending on factors such as location, state, and the company you work for.

The highest paying states like New York and Vermont offer impressive annual salaries, while the lowest paying states like Arkansas and Florida offer lower salaries.

Western states like California and Alaska have average salaries, while southern states like Texas and Louisiana offer slightly lower averages.

Northeastern states like Massachusetts and Connecticut have a higher average salary range.

Overall, these factors play a significant role in determining the potential income you can earn from an oil well.